Quick mortgage calculator how much can i borrow

You could borrow 10000 over 48 months with 48 monthly repayments of 22936Representative 49 APR annual interest rate fixed 479. This representative APR Representative APR The representative APR is the rate that at least 51 of people are expected to receive when taking out a loan within the stated amount and term range.

15 Year Mortgage Calculator Calculate Local 15 Yr Home Loan Refi Payments Nationwide

Use our mortgage calculator to estimate your monthly house payment including principal and interest property taxes and insurance.

. Our calculator includes amoritization tables bi-weekly savings. Its free to use and there are no credit checks involved. How much to put down.

Are you looking to buy a home. Buy-to-let calculator see if we could lend you the amount you need for a property youll rent out. Click here to see our full line of mortgage calculator embed options.

You can also use our mortgage payment calculator to see the impact of making a higher down payment. Get a quick quote for how much you could borrow for a property youll live in based on your financial situation. Start web chat Call us.

Use one of these quick formulas to help make sure you dont end up house poor. With just a few quick questions our online mortgage calculator will give you an idea of how much you could borrow show your mortgage rates and compare monthly payments. We recommend seeking financial advice about your situation and goals before getting a financial product.

A quick conversation with your lender about your income assets and down payment is all it takes to get prequalified. This means that you can borrow 70 of the purchase price while the minimum deposit is 30. A mortgage calculator can help borrowers estimate their monthly mortgage payments based on the purchase price down payment interest rate and other monthly homeowner expenses.

With a quick sight you can see how. If youre already a mortgage customer and you want to switch your deal please login to manage your mortgage to see what we can offer you. Your income expenses and deposit are the biggest factors determining your borrowing power but lenders also consider other factors such as your existing debts and if you are using a guarantor for the loan.

You are looking to change from your current rate to a new mortgage and borrow more on top of what you owe on your current mortgage. An AIP is a personalised indication of how much you could borrow. Gauging the approximate cost of your monthly repayments using our mortgage calculator is easy.

This calculator is for information purposes only and does not provide financial advice. You can call us on Monday to Friday from 7am to 8pm and on Saturday and Sunday from 7am to 5pm. The High Cost of Quick Decisions.

Mortgage Calculator Use our quick mortgage calculator to calculate the payments on one or more mortgages interest only or repayment. The rule states that your mortgage should be no more than 28 percent of your total monthly gross income and no more than 36 percent of your total debt. Use our mortgage calculator to get a rough idea of what you could borrow.

Mortgage Overpayment Calculator Use our Mortgage Overpayment Calculator to see how overpaying your mortgage payment can reduce the total cost of your mortgage. Use our offset calculator to see how your savings could reduce your mortgage term or monthly. This mortgage borrowing calculator is designed to give you a quick idea of the likely mortgage amount you can borrow based on your perceived affordability.

Chat to us online if you have a question about using our mortgage calculator. Using a percentage of your income can help determine how much house you can affordFor example the 2836 rule may help you decide how much to spend on a home. 2000 cashback when you refinance to us If youre eligible and you apply to move your home loan to us by 28 February 2023 you could get less home load with 2000 cashback.

The Mortgage Calculator provides an overview of how much you can expect to pay each month including taxes and insurance. Its important not to spend too much on a property. How much can I borrow.

Mortgage calculators can be useful to get a rough idea of your total borrowing but keep in mind that they are unable to take into account your personal circumstances and therefore there may be additional factors that affect the actual amount you can borrow. Most people need a mortgage to finance a home purchase. Think carefully before securing other debts against your home.

Also offers loan performance graphs biweekly savings comparisons and easy to print amortization schedules. You could lose your home if you do not keep up payments on your mortgage. After putting in just a few digits you will find out what your monthly payment and total payments will be.

To talk to one of our team at ANZ please call 0800 269 4663 or for more information about ANZs financial advice service or to view our financial advice. First simply input in the total amount that you think youll need to borrow and detail how many years you would like the loan over normally for new mortgages for first-time buyers this will be around 25 years however more lenders are now happy to offer mortgages over periods. It takes about five to ten minutes.

Affordability calculator get a more accurate estimate of how much you could borrow from us. It will not impact your credit score and takes less than 10 minutes. The answer is yes.

Mortgage calculator is a simple tool that helps you estimate the cost of your mortgage. How Much Can You Afford to Borrow. A higher down payment will lower your monthly payments not only because it reduces the amount of money you borrow but also.

Check out the webs best free mortgage calculator to save money on your home loan today. Use our borrowing calculator to work out how much you could borrow for a home loan to buy a house and what your home loan repayments might be. Estimate your monthly payments with PMI taxes homeowners insurance HOA fees current loan rates more.

Between 2015 and 2016 nearly one in three UK consumers chose mortgage products which cost them more than 550 per year. Mortgage lending statistics. This Buy to Let mortgage calculator is designed to give you a quick idea of the likely mortgage amount you can borrow based on rental income coming in however this amount is subject to lots of different things such as your credit history monthly outgoings and deposit.

Browse through a vast selection of bank loan packages using our mortgage tool. Please get in touch over the phone or visit us in branch. How much house can I afford.

Mortgages are secured on your home. How much can I borrow. However this amount is subject to lots of different things such as your credit history monthly outgoings and deposit.

Home loan comparison - You can compare the best housing loans for your need. Our borrowing power calculator asks you to enter details including your loan term and interest rate income and expenses and any. Offset calculator see how much you could save.

While 20 percent is thought of as the standard down. Lets start by getting you to the right place. Home Loan Refinancing Calculator This is a simple housing loan calculator that estimates how much you can save on your monthly housing loan instalments if you refinance your property.

Home Affordability Calculator For Excel

Va Mortgage Calculator Calculate Va Loan Payments

Usda Loan Payment Calculator Calculate Loan Guarantee Eligibility Closing Costs How Much You Can Afford To Borrow

Loan Calculator Wolfram Alpha

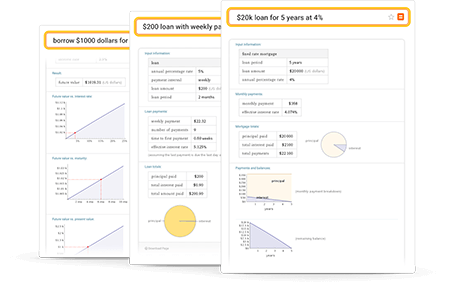

5 Best Mortgage Calculators How Much House Can You Afford

5 Best Mortgage Calculators How Much House Can You Afford

5 Best Mortgage Calculators How Much House Can You Afford

:max_bytes(150000):strip_icc()/MortgateRates.Fed.StL-0099d59e398e4f239bc0cc4154e04cb7.jpg)

Mortgage Calculator

Loan Calculator Credit Karma

Mortgage Calculator Money

5 Best Mortgage Calculators How Much House Can You Afford

Mortgage Calculator How To Use One Lendingtree

Can I Afford To Buy A Home Mortgage Affordability Calculator

5 Best Mortgage Calculators How Much House Can You Afford

/MortgateRates.Fed.StL-0099d59e398e4f239bc0cc4154e04cb7.jpg)

Mortgage Calculator

5 Best Mortgage Calculators How Much House Can You Afford

How Much A 350 000 Mortgage Will Cost You Credible